We provide discreet, specialist accounting for OnlyFans creators, ensuring full tax and accounting compliance while maximising your take-home income.

164 Tax Returns submitted in the last 7 days

We understand that as a content creator, your time and energy go into producing amazing content, engaging with your fans, and growing your brand. The last thing you want is to spend hours stressing over tax returns, bookkeeping, or chasing receipts. That’s where we come in.

At One & Only Accounts, we specialise in helping content creators working on platforms such as OnlyFans, Fansly, JustForFans, ManyVids, as well as other adult-industry professionals. We know your work is unique, and so are your financial needs. Our friendly, non-judgmental team is here to take the pressure off by handling everything from self-assessment tax returns and expense tracking to business setup advice and ongoing support.

Find out more

Whether you’re just starting out or already established with a loyal following, we’ll make sure your finances are in safe hands. We take the time to understand your situation, explain everything clearly, and keep things simple - no jargon, no judgement, just solid advice you can trust.

Let us take care of the numbers, so you can focus on creating content, growing your income, and building the life you want.

Find out moreWe specialise in working with creators across every major platform — whether you’re streaming, influencing, monetising adult content or running a membership-only channel.

We provide discreet, specialist accounting for OnlyFans creators, ensuring full tax and accounting compliance while maximising your take-home income.

Fansly creators trust us to manage their tax and accounting affairs professionally and confidentially, leaving them free to focus on creating amazing content.

We help YouTubers of all sizes manage tax, income tracking and expenses so they can focus on creating great content.

We offer confidential, creator-focused accounting for Just4Fans performers, keeping your earnings organised and your tax obligations fully covered.

We support ManyVids performers with clear, hassle-free accounting that keeps earnings organised and tax obligations covered.

From brand deals to creator fund payouts, we handle the accounting so TikTok creators can grow without the admin stress.

If you know somebody who is in need of tax advice, simply refer them to us by email and if they go ahead with using our services, you will receive a £50 referral fee as a thank you from us!

At One & Only Accounts, we’re not just any accounting firm - we specialise in serving top earning OnlyFans content creators. We understand the unique financial landscape you navigate, from fluctuating income and subscription models to managing tips, paid content, and exclusive fan interactions. We take the time to understand your business, ensuring our services are perfectly suited to your needs.

Your time is valuable. You shouldn’t have to worry about submitting OnlyFans tax returns, bookeeping, or complex deductions. We take all the financial stress off your plate, giving you the freedom to focus on what truly matters - your content and your community. With One & Only Accounts, you can trust that your finances are in good hands.

Our goal is to help you keep as much of your hard-earned money as possible. Our team will help you with tax efficient tax services, ensuring that you can reinvest more back in your business and plan for long-term growth.

Navigating tax laws and compliance can be a nightmare for creators. We make sure you're always in the clear—no more worrying about audits or fines. With One & Only Accounts, we stay on top of the latest regulations so that you don’t have to.

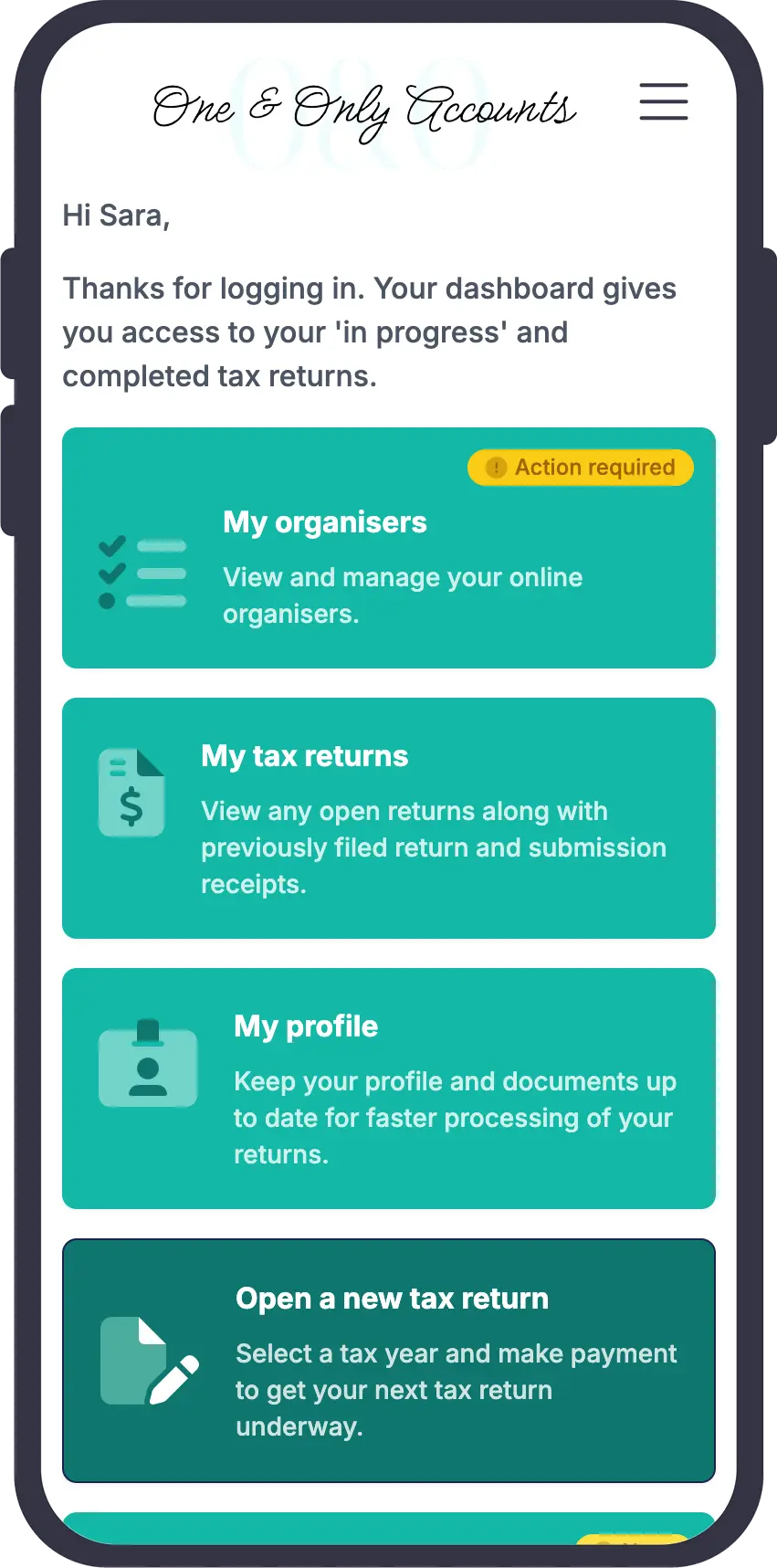

Drop us an email and we'll arrange a call so we can fully understand your situation.

Use our exclusive online portal to enter your information and manage your account.

Sit back and relax, focus on your content and let us handle the rest.

We offer a number of fixed packages plus tailored services to suit your needs. Whether you’re looking for a one-off consultation or ongoing support, we’re here to help.

Personalised Guidance: Speak one-on-one with an expert who understands the OnlyFans creator landscape.

Clarify Your Concerns: Get answers to any questions about tax filings, managing your earnings, or business setup.

Strategic Advice: We’ll offer insights into how to save on taxes, structure your finances, and plan for the future.

Full Tax Filing: We’ll prepare and file your tax return, ensuring you comply with all tax regulations.

Maximised Deductions: We’ll identify all eligible deductions to ensure you’re paying the least amount of tax possible.

Clear and Transparent Reporting: We provide a simple, easy-to-understand breakdown of your tax situation.

Company Accounts Preparation: We'll prepare your statutory accounts in line with Companies House and HMRC requirements.

Corporation Tax Return (CT600): Full calculation and filing, ensuring all allowances and reliefs are applied.

Companies House Filing: We'll handle your annual submission so you never miss a deadline.

VAT Returns (Optional Add-On): Quarterly VAT return filing, including Making Tax Digital compliance and ongoing advice.

Ongoing Support & Tax Efficiency: From dividend planning to director’s responsibilities, we’re here with proactive, jargon-free advice.

Don't just take our word for it, we're helping hundreds of OnlyFans navigate their finances.

Experts in their field!

They help make my life easier and more manageable.

23 January 2025

Highly recommended!!

Very professional, friendly and quick to reply to emails - dealt with a lot of my concerns and questions, and overall got my tax returns sorted and submitted in good time.

17 January 2025

One and Only Accounts provided a second to none service.

They are incredibly professional, efficient and helpful. I would have absolutely no hesitation whatsoever recommending them to anyone seeking excellent accountancy services.

1 December 2024

Here are some of the most common questions we get asked. Feel free to get in touch with us.

A tax return is a form that individuals and businesses in the UK must submit to HMRC (His Majesty's Revenue and Customs), detailing their income, expenses, and other relevant information for tax purposes. It helps HMRC calculate how much tax is owed or whether a refund is due.

The tax year in the UK, runs from 6th April to the following 5th April (365 days).

Our tax return service is from £395.

Filing a tax return is not just a good practice – it's a legal requirement for many individuals and businesses in the UK. HMRC mandates that anyone with income outside of standard PAYE or with complex financial affairs must submit a tax return. Filing ensures compliance with UK tax laws and helps maintain transparency in your financial dealings.

It also gives you the opportunity to claim allowances and deductions you may be entitled to, ultimately helping you manage your tax liability.

Not filing can result in penalties, interest charges, and potential legal action, so it's crucial to stay on top of your obligations. Let One & Only Accounts guide you through the process with clarity and ease.

Simply get in touch with us to schedule a consultation. We will discuss your situation, gather the necessary information, and guide you through the process of filing your tax return accurately and on time.

Latest Articles

Get in Touch Today! We specialise in tax for digital creators. Whether you're a side hustler or full-time creator, One & Only Accounts is here to help you navigate your OnlyFans tax obligations seamlessly.

Give us a call on 07851 074 930, drop us a message on Whatsapp or fill in the form below.

Message us on Whatsapp