What is the Common Reporting Standard?

The Common Reporting Standard (CRS) is a global mechanism requiring financial institutions to automatically share financial account data with tax authorities.

Its core purpose is to help governments detect undeclared offshore income.

The CRS affects social media influencers and content creators earning income worldwide because it can reveal previously hidden foreign account details to HMRC.

Chapters

- What is the CRS (Common Reporting Standard)?

- How does the Common Reporting Standard work?

- When was the CRS Introduced and Why?

- Pros and Cons of the CRS

- How does the CRS affect content creators?

- What Must Content Creators Do?

- Summary

What is the CRS (Common Reporting Standard)?

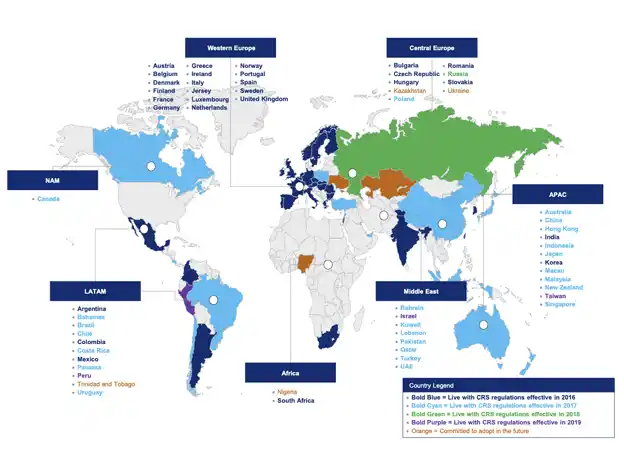

Image credit: Citi

The Common Reporting Standard (developed by the OECD in 2014) is an international regime for the automatic exchange of financial account information between 38 participating countries, which are:

| Australia | Greece | New Zealand |

| Austria | Hungary | Norway |

| Belgium | Iceland | Poland |

| Canada | Ireland | Portugal |

| Chile | Israel | Slovak Republic |

| Colombia | Italy | Slovenia |

| Costa Rica | Japan | Spain |

| Czechia | Korea | Sweden |

| Denmark | Latvia | Switzerland |

| Estonia | Lithuania | Turkey |

| Finland | Luxembourg | United Kingdom |

| France | Mexico | United States |

| Germany | Netherlands |

It standardises the type of information that banks, investment managers, and insurers collect about account holders.

Annually they report to their home tax authorities for onward exchange with other countries.

The Common Reporting Standard (CRS) applies to financial assets such as bank balances, dividends, interest, and proceeds from the sale of assets held offshore.

How does the Common Reporting Standard work?

Financial institutions operating in CRS-participating countries must perform due diligence to establish each account holder’s tax residence by gathering data such as name, taxpayer ID number, account balance, and income details.

This information is submitted to the local tax authority, which exchanges it with relevant foreign jurisdictions where the individual is tax resident.

The information is usually submitted by 31 May following the year-end for accounts held the previous year.

The Common Reporting Standard requires robust data protection practices and confidentiality safeguards to prevent misuse of private financial information.

When was the CRS Introduced and Why?

In May 2014, G20 and OECD nations adopted a multilateral framework known as the Multilateral Competent Authority Agreement (MCAA) to facilitate automatic exchange of details under CRS.

Reporting began in 2017 for early adopters, later expanding to over 38 countries as of today.

The main purpose was to clamp down on offshore tax evasion by making data about foreign financial holdings visible to home tax authorities.

Recent OECD updates have extended CRS to include crypto‑asset holdings and electronic money products not originally captured by the standard.

Pros and Cons of the CRS

The Common Reporting Standard has clear benefits and drawbacks, especially for UK-based content creators with offshore accounts or digital assets.

Pros

- Greater global tax transparency helps reduce hidden offshore income and ensures fair taxation across countries.

- CRS helps deter tax evasion and encourages accurate reporting by increasing the risk of detection.

- Automatic data exchange reduces the need for authorities to issue specific information requests or rely on whistleblowers.

Cons

- GCRS may lead to privacy concerns since sensitive financial information is transmitted across national borders to multiple tax authorities.

- Reporting requirements and data accuracy burdens fall on financial institutions, who may face penalties for misreporting.

How does the CRS affect content creators?

Many social media content creators including YouTubers, Twitch streamers, and OnlyFans earners tend to have multiple sources of income.

Some may hold foreign bank or investment accounts, receive payments via offshore companies, or earn from foreign platforms.

Under the CRS, any financial accounts held in non-UK jurisdictions that are with reporting institutions will have to share data with HMRC.

That means if you receive payments overseas or hold foreign financial assets, HMRC may become aware even if you didn’t report the income voluntarily.

This increases the potential risk of investigation and penalties for undeclared earnings.

What Must Content Creators Do?

UK-based content creators should take proactive steps to remain compliant, including:

- Understand whether you hold accounts abroad or receive payments into foreign jurisdictions.

- Keep accurate accounting records, including foreign revenue streams like platform subscriptions or international sponsorships.

- Declare all income on your Self Assessment tax return, even if earnings are held in offshore accounts.

- Be prepared for HMRC to receive automatic data on your foreign accounts, since HMRC may cross-check income reported against this information.

- Seek help from a specialist accountant if you are unsure how CRS applies to your situation or if you hold foreign assets or crypto-assets.

Summary

The Common Reporting Standard is a global tax transparency framework developed by the OECD.

It requires financial institutions to gather and exchange account holder information with tax authorities.

Introduced in 2014 and implemented in 2017, CRS aims to combat offshore tax evasion by promoting the automatic exchange of data.

For UK-based content creators and influencers, CRS affects any offshore account holdings or foreign income streams by increasing HMRC visibility over previously hidden financial assets.

Staying lawful means understanding your global accounts, declaring all income accurately, and potentially seeking specialist accountancy advice to avoid penalties and compliance checks.

Disclaimer: Any advice in this publication is not intended or written by One and Only Accounts to be used by a client or entity for the purpose of (i) avoiding penalties that may be imposed on any taxpayer or (ii) promoting, marketing or recommending to another party matters herein.